pa estate tax exemption

There is no exemption nor is there an exclusion under which no tax will apply. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

This group is known as.

. Being a homeowner in Pennsylvania can qualify you for another property tax relief programthe state property tax reduction allocation. It grants partial refunds every year. Posted in Real Estate Taxes.

While the majority of realty transfer tax is deposited into Pennsylvanias General Fund 15 percent of collections are dedicated to the Keystone Recreation Park and Conservation Fund. Estate Tax Return IRS Form 706 by eliminating the Federal Credit for State Death Taxes and replacing it with a deduction for death taxes actually paid to the states. Transfers to siblings half-siblings by blood or adoption but not step-siblings are subject to a 12 inheritance tax.

A transfer is made under a plan confirmed under section 1225 of the Bankruptcy Act only when the transfer is authorized by the specific terms of a previously confirmed Chapter 12 plan. In order to qualify for the tax exemption certain qualifications need to be met. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or income to take up to 3500 from the decedents bank account until the estate account is opened.

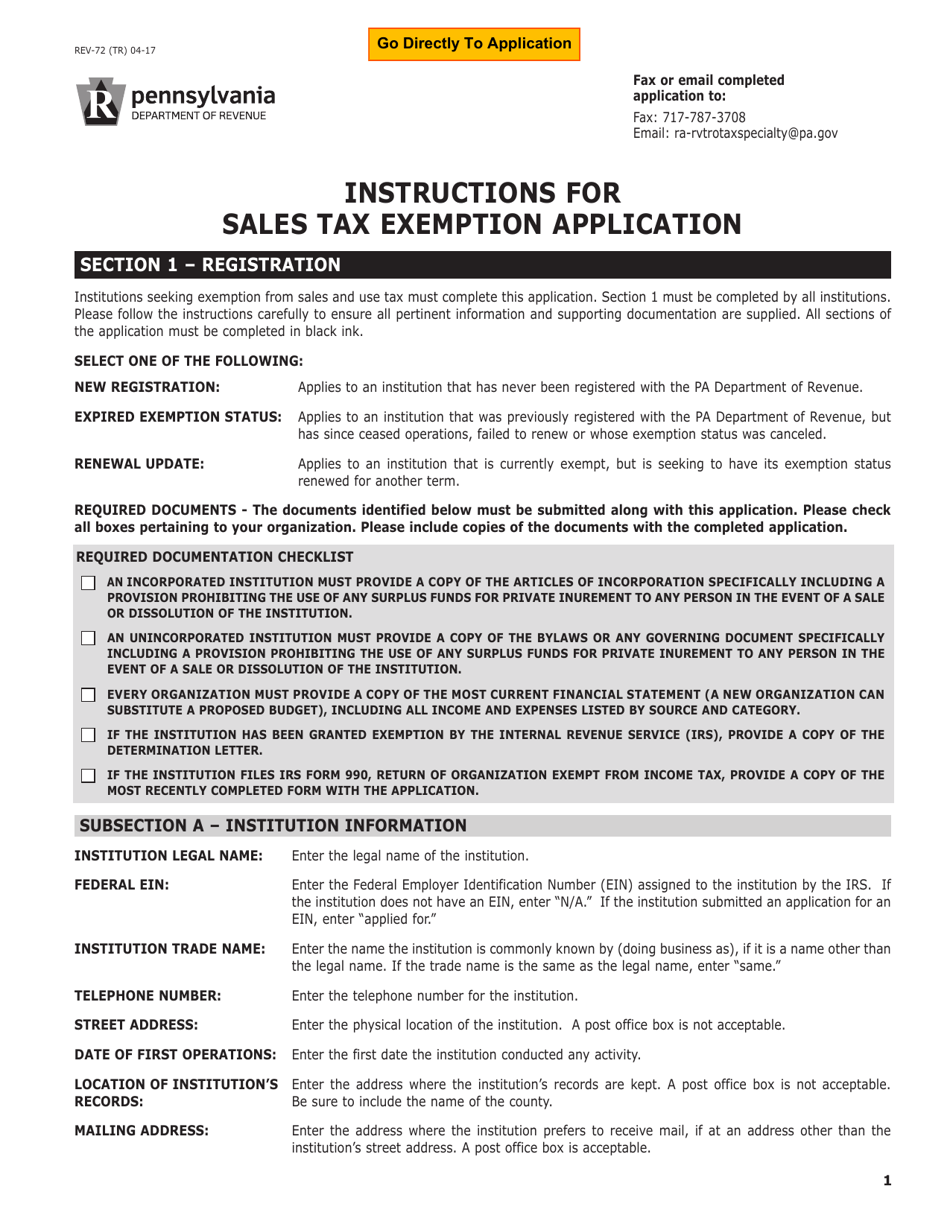

Ad Download or Email PA REV-1737-1 More Fillable Forms Register and Subscribe Now. For decedents dying after Jan. Download Or Email PA REV-72 More Fillable Forms Register and Subscribe Now.

Pennsylvania imposes an inheritance tax on a decedents taxable estate. Update on Pennsylvanias Real Estate Tax Purely Public Charity Exemption and PILOTs. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code.

Transfers to grandparents parents descendants which include adopted and step-descendants are subject to a 45 inheritance tax. Nonprofit entities that own Pennsylvania real property are under relentless attack from local taxing jurisdictions regarding the exempt status of property used for charitable purposes and thus must be ever. PA Property Tax Relief for All Homeowners.

Does Pennsylvania have an estate tax. In an action in which taxpayers presented constitutional challenges to the imposition of a tax at the 1 rate established by the Pennsylvania Realty Transfer Tax Act within the context of a real estate transfer in which one party to the transaction is exempt the Act did not discriminate against parties dealing with the Federal government in violation of the Federal supremacy. At death a persons assets are frozen until the Executor goes to the Register of Wills with the.

Fortunately Pennsylvania does not have an estate tax. The rates for Pennsylvania inheritance tax are as follows. Federal estate tax exemption.

Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption. 2 No part of the organizations net income can inure to the direct benefit of any individual.

You can learn more from the PA Department of Military and Veterans Affairs. In addition to the property tax exemption for veterans Pennsylvania has a Property TaxRebate program that is used to help senior citizens and disabled persons. An exempt organization or institution shall have an exemption number assigned by the PA Department of Revenue and diplomats shall have an.

Who is entitled to claim the family exemption for inheritance tax. This tax relief program uses the casino gambling revenue from the state. Pennsylvania Department of Revenue Tax Types Sales Use and Hotel Occupancy Tax Non-Profit.

Relating to acquired real estate company. TAX 2012 2 modities ricultural U e following Estate Tax imal produ ercial purp land less r improvem ands used uty and op inatory ba e of produ ting the re ursuant to deral agen tocked by products. 12 percent on transfers to.

3 The organizations conduct must be primarily supported by government grants or contracts funds solicited from its own membership congregation or previous donors and. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Download Or Email REV-1220 AS More Fillable Forms Try for Free Now.

Property TaxRent Rebate Status. E Busines to the bus et of family rty or for l estate w mption th e of the de the owners he business death. 1 Organization must be tax-exempt under the Internal Revenue Code.

The tax applies to every dollar of the estate in excess of expenses and debts. Pennsylvania Inheritance Tax Rates 2020. But just because you dont have an issue at the state level does it mean that this cant be a problem at the federal level.

If your estate exceeds the federal exemption amount you could face a huge liability. A farmstead is defined as all buildings and structures on a farm not less than ten contiguous acres in area not otherwise exempt from real property taxation or qualified for any other abatement or exclusion pursuant to any other law that are used primarily to produce or store any farm product produced on the farm for purposes of commercial agricultural production to. To qualify for this tax relief you need to meet certain requirements.

However the estate tax provisions of. No estate will have to pay estate tax from Pennsylvania. The total income from Line 9 of the pro-forma PA-40 Personal Income Tax Return and any nontaxable income allocated to the bankruptcy estate that would be eligibility income for Tax Forgiveness on PA-40 Schedule SP are also included as eligibility income on Part C Line 10 Cash received for personal purposes from outside your home of PA-40 Schedule SP.

45 percent on transfers to direct descendants and lineal heirs. It is a PA-funded homestead exclusion that lowers taxable values across the state but the exact amounts are set by counties. This group is known as Class A.

Transfers made prior to plan confirmation do not qualify for tax exemption. Exemption limited to purchase of tangible personal property or services for use and not for sale. By Paul Morcom on October 16 2018.

29 1995 the family exemption is 3500. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural culture and family farms intact for future generations.

The tax rate is dependent upon the relationship between the decedent and the beneficiary. As the Federal Credit for State Death Taxes was discontinued there no longer is a basis for Pennsylvania estate tax. The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100 disabled is a resident of the Commonwealth of Pennsylvania and has a financial need.

The exemption shall not be used by a contractor performing servic-es to real property. 13 rows Federal Estate Tax. Wheres My Income Tax Refund.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

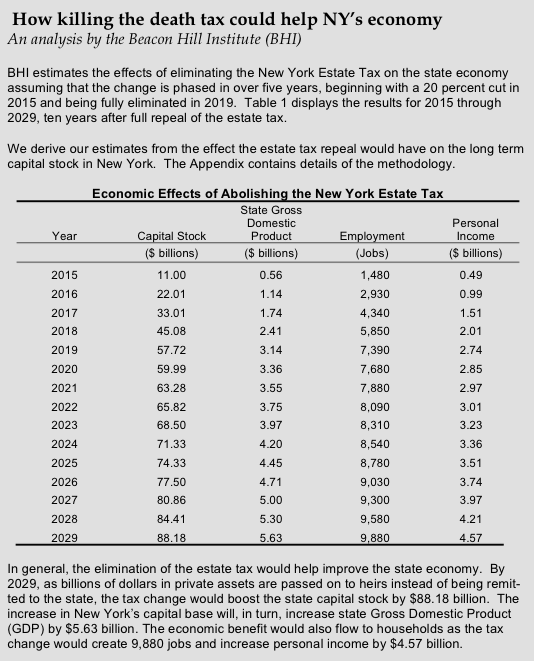

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

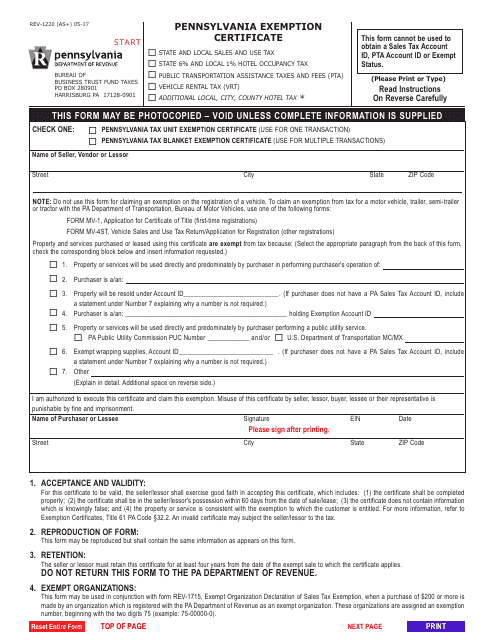

Form Rev 1220 As Download Fillable Pdf Or Fill Online Pennsylvania Exemption Certificate Pennsylvania Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Do I Need To Pay Inheritance Taxes Postic Bates P C

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Form Rev 72 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Pennsylvania Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die